Written by: Adrian Mondy | Grain Marketing Advisor | 0428 722 524

As a Grain Marketing Advisor, I am obviously trying to achieve the best possible outcome for my clients when it comes to the sale of their grain. A large part of the role involves accessing all pricing options available to aid in making the right decision at the time (whether it’s the right decision later on is sometimes debatable!) and since we are predominantly an export orientated state, most of the bids are from buyers who trade in bulk shipments.

Another well-known avenue for selling grain is the DEU (delivered end user) market which includes delivering to domestic users such as feed/pellet mills, feedlots, chook farms etc. or to those buyers who intend to containerise (Or Box) and export the grain. Despite representing only 3% of all shipments from WA, it is this last option that I thought might be worth exploring in order to gain a better understanding of how the mechanics of this market effect the buyer’s bids.

THE STATS – Grain Types and Destinations

As mentioned above, bulk shipping and bulk grain supply chains dominate the WA market, but containerised grain exports continue to play an important role for certain grain exports from here, and even more so, from the East Coast.

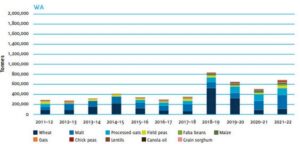

The mix of crops exported via containerisation differs between the states with Victoria focusing on wheat, lentils and faba beans whereas wheat, chickpeas and sorghum dominate exports from NSW and Qld. SA exports feature lentils, faba beans, wheat, field peas and malt, which is quite similar to the WA market as per Figure 1.

FIGURE 1: Containerised grain exports from WA 2011 – 2022 (AEGIC)

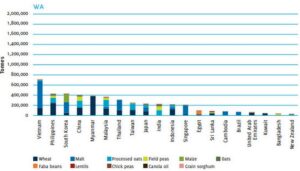

The destinations for these grain types are, however, is quite selective with pulses sent mostly to the subcontinent, Egypt and some Middle Eastern countries, sorghum to Japan, malt primarily to Korea, Vietnam and Thailand and wheat to China and some Southeast Asian countries (as per figure 2).

FIGURE 2: Major destinations for containerised grain exports from WA 2011 – 2022 (AEGIC)

Container pricing & logistics

In WA we are limited to only one major container terminal, so most containers are funnelled through Fremantle (some leave from the Esperance port) via one of several shipping companies that include CMA-CGM (French), Maersk (German), MSC (Swiss), COSCO & OOCL (Chinese) to name a few. The cost of containers is largely determined by:

- Local Supply – this is influenced by the level of imports coming into the state. As the economy slows, so does the level of goods coming in meaning there are fewer containers available = price increase.

- Local Demand – export demand for grain, scrap metal & paper, mining, mineral sands etc. and

- Global Factors such as global S&D’s, port congestions, fuel costs and the health of the major economies around the world.

Once a container is booked, the exporter has it for 14 days prior to the estimated time of departure and will be charged daily penalties over and above that time. The importer at the other end is allowed 11-14 days to empty and return the container and they will also be charged penalties for any delays.

In terms of packing the containers, there are 3 container parks at Fremantle and 1 near MGC and the containers need to be moved via truck or rail from there to the packing site then back to the terminal once full.

As with almost everything we discuss these days, we talk in pre & post covid terms, and the grain container business is no exception. Globally, the pandemic had a resounding effect on the trade of containerised goods, including grains. As cities and ports were locked down, household consumption patterns changed and this reduced the continuity of supply of household goods from manufacturers. As a result, access to containers eroded, as did the reliable supply of containerised goods, which resulted in massive increases in the cost of sea freight as per Figure 3.

FIGURE 3: The Freightos Baltic Global Container Index ($USD/40ft box)

Margins & risks

Pre-Covid, rates (based on the hire of the container prior to loading to return at the importer end) could be locked in for 3-4 months and would be fixed regardless of when the vessel left port so the trader knew what they were up for and could reliably include that in the cost of purchasing grain. During the height of the pandemic, shippers would only release their rates monthly, and these increased alarmingly during 2021/22 which made it very risky for traders to do much business in advance. The market is now returning to some sort of normality with rates back to around $1000 USD but at its peak, 40ft containers going from China to California

were charged out at $15,000 USD!

Despite container rates returning to more manageable levels, local exporters are reporting that margins in the northern hemisphere have fallen even faster due to the increase in margins for bulk shippers. This has resulted in less demand for container exports as some buyers, who normally import containerised grain, have joined forces and switched to bulk imports. In addition to this, rates on the east coast are almost half of what they are here in WA which is making life difficult for our local exporters.

Aside from the penalties for extra time mentioned previously, there are other risks that the exporter must manage. These include containers failing AO inspections, missed vessels and vessel rollovers, missed booking slots when delivering to the terminal and container damage to name a few. These, and the cost of the boxes themselves, will all be considered and factored in when producing a bid to the grower for their grain.

As I mentioned at the beginning of this article, my role as an advisor is to help my client make the right decision when selling their grain. Comparing prices is one part of the puzzle but trying to ascertain why these prices are there is just as important (and much more difficult!) because then our decision becomes an educated one. There is always a plethora of information at our disposal when attempting to understand why prices are at certain levels but most of this relates to bulk shipping bids which might lead us to assume that the DEU market is not affected by global issues. Hopefully this article will shed some light on our local containerised grain market and the challenges they face when trying to compete for our client’s grain.