A hangover: ‘fleeting pleasure traded for tomorrow’s discomfort, a zero-sum exchange where momentary joy equals morning’s regret’.

With harvest winding to a close for many, it’s not just a rowdy cut-out that will lead to headaches for farmers and businesses across Australia over the coming months and years.

I’m referring to the hangover from the COVID stimulus package introduced by the Federal Government in 2020. While JobKeeper and other cash payments came and went, temporary full expensing of equipment and instant asset write-offs were warmly welcomed through the 2020/21 to 2022/23 financial years.

The timing was impeccable for many, coinciding with high grain and livestock prices plus strong yields. Business operating profits were often the highest they had ever been, and these asset-based concessions provided big incentives to upgrade plant whilst reducing the tax man’s take. The impact on equipment demand was huge, which combined with supply chain shortages to put a rocket under the price of farm gear (and well, pretty much everything!).

Alongside high input prices, the incentive was an undoubted driver of tech adoption, improving productivity and safety in farm businesses. Now that the proverbial music has stopped, where to next?

The short answer, speak with your accountant. The longer answer is that it’s complicated, but informed planning around equipment changeovers is very important to avoid nasty surprises.

COVID-era tax incentives

A quick refresher on Instant Asset Write-offs and Temporary Full Expensing.

- Both typically applied to businesses with a turnover of up to $500M and using Simplified Depreciation Rules (utilising Small Business Pool).

- Instant Asset Write-offs mandated the single year expensing of individual capital items up to the value of $149,999 in the year of purchase, when purchased between 12 March 2020 and 30 June 2023.

- Temporary Full Expensing (TFE) applied to any capital item over the value of $150,000 purchased between October 2020 and June 2023, and gave businesses the choice to write these items off in a single year (like above) or opt-out and depreciate the asset over its effective life.

- TFE also forced businesses to the write-off the balance of their Small Business Pool in June 2021, June 2022 and June 2023.

It is a complex arrangement with some nuance around specific dates, but the result is hundreds of millions of dollars’ worth of gear in farm sheds bought in the last three years, which the ATO believes has zero-dollar value. This all means that taxable income for the foreseeable future will be higher (nil to less depreciation) plus in many circumstances profit on the sale / trade of seconds hand goods.

It all catches up in the end.

Timing and previous tax treatment of the asset sold will determine the financial outcome, so it’s vital that you consult your accountant if you’re unsure of the status of an item to be sold or traded.

One thing for certain is that if the asset’s value was written off by COVID-era incentives, either directly or via the business pool – business as usual will see its sale value flow through to business profit and tax bills.

An example for businesses with <$10m turnover with new assets purchased in 23/24.

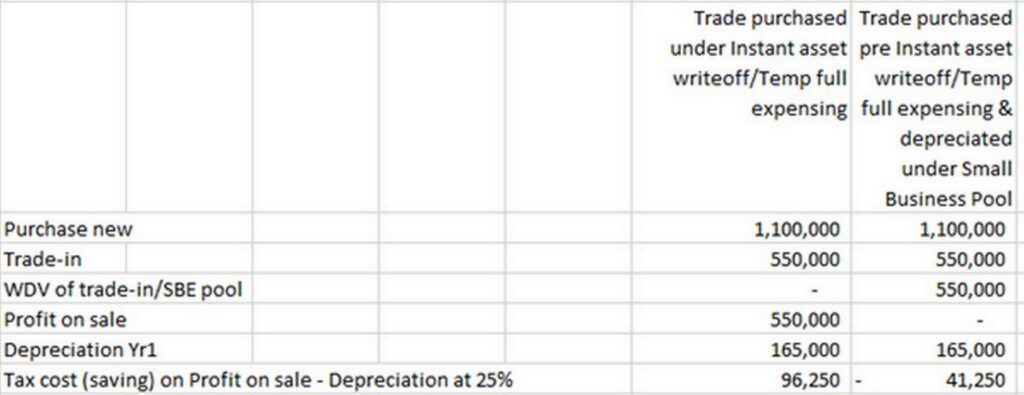

This business buys a new harvester and front for $1.1M with a trade valued at $550,000 – we are considering the tax implications of two scenarios trading a machine.

- Which was bought and written-off during COVID incentives (and chose not to opt-out).

- That was owned prior to COVID incentives and written off in the Small Business pool.

In the above table the key difference in the two scenarios is that if the item being traded was purchased under instant asset write off / TFE then the trade value will be treated as profit with depreciation on the purchase being the deduction.

Whereas if the item was purchased pre TFE and depreciated under the small business pool then there is no tax on the trade value.

There are some ways to manage this burden, which include.

- Maximising the effective life of these high-market value, written-off assets. Reducing the eventual sale value whilst improving the capital efficiency of the business. Think pushing the seeder tractor to 12,000hrs rather than rolling at 8,000.

- Recognising that trading machines already on the books at October 2020 will likely have less tax implications than those purchased and written-off immediately under Temporary Full Expensing.

- Minimising the fair market value on trade-ins.

- Talk to your accountant about the possibility leasing new items.

- Ensuring that your business operating structure is appropriate to manage your expected ongoing profitability, with a view to minimise the rate of tax paid on profits that will inevitably flow from the sale of

written-down machines.

Summing it up

I always preface these conversations with clients with the disclaimer that I’m not an accountant, so speak with yours before making any decisions based on what we’ve just discussed. The same holds true here, with more complexity to these issues than I’ve mentioned in this article, it’s very important to get the right advice from your tax expert.

Irrespective, it’s clear that the COVID-era tax incentives and their alignment with record operating profitability for West Australian farm businesses was something of a perfect storm. Heavy investment was made, most of it well thought out, other decisions less so. In the sober light of the 2023/24 financial year, these decisions from 2-3 years ago are beginning to hit the bottom line. Many businesses have

bought, built, and filled the machinery shed, it’s now time to face up to those tax bills that were so blissfully deferred.