The 2024 season is well and truly upon us and with January now over it feels like there are so many jobs to do, it’s an exciting time of year.

Our short sharp harvest allowed a good amount of down time to recharge and reset which has been well overdue for so many. Last season will be one to remember and fortunately, we were supported by two of WA’s biggest seasons on record. Annual budgets are in full swing with the cost of production playing a significant role in this year’s budget despite WA growers increasing ability to grow more grain on less rain.

As we transition into our new 2024 season mode, our optimism is renewed as we prepare to do it again all over – it’s what we know and love, it’s what we do best and of course we look forward to improved seasonal conditions.

In the world of grain marketing, it’s against the rules to look back. However, it is difficult not to look back over the past two years of market madness. What just happened? What could or should we have done? How can I improve? These are the questions I ask myself and perhaps you have too?

It’s a fresh start, a new season – let’s go, let’s be better!

The optimal ‘Guide to Grain Marketing’ suggests keeping your plan simple and in line with your attitude to risk – implementing your strategy without emotion or distraction, at a time when you’re not busy or stressed allowing calculated and sound decision making – easier said than done I hear you say!

Despite an ongoing war between two of the world’s largest grain producers, international markets are subdued although globally, Russia and Ukraine remain very much on the watch & monitor radar. The Israel Gaza war is pressuring global shipping to either navigate the Suez Canal with severe risk or take costly and timely detours. Despite humanitarian devastation, these issues are competitively supportive of Australian grains into Asian, Middle East and Eastern African markets (moreso wheat and barley). Though less than ideal for Australia’s Canola market into Europe which will favour Ukrainian and Canadian Canola shipping.

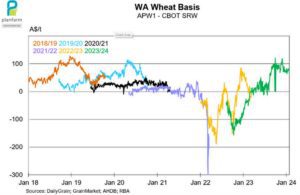

GIWA’s December 2023 production estimates at 14.3 MMT (all grains) reflect a 45% decrease on 2022/23 season’s 26 MMT record. WA’s contrasting seasons and reduced production has had a dramatic effect on our Basis which has sat in positive territory for the past six months, exceeding +$100/t all port zones late November and currently maintaining +$70/t to +$80/t levels. Amazing really – when only 18 months prior our Basis was firmly negative as demonstrated in the chart below.

Chart 1 – Kwinana port zone basis

It has been comforting to see our WA buyers return from the Christmas New Year trading lull and continue to offer strong wheat cash pricing opportunities across all port zones.

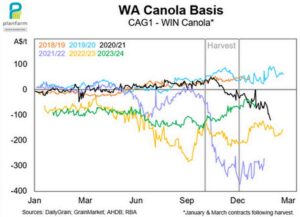

Chart 2 – Kwinana GM Canola BASIS

Current 23/24 Canola cash pricing hovers around Decile 6 levels reflecting very little local buyer interest on account of reduced international demand together with significant 22/23 season supply which crept into the early slots of new season shipping stem.

WA’S oversupply and shipping constraints have eased significantly on account of CBH Operations’ record shipping program followed by 2023 season’s shortfall (moreso for wheat, lupin and oat). It is therefore assumed WA carryover stocks will be lean heading into our new season. These factors are supportive of a strong outlook for our WA BASIS levels.

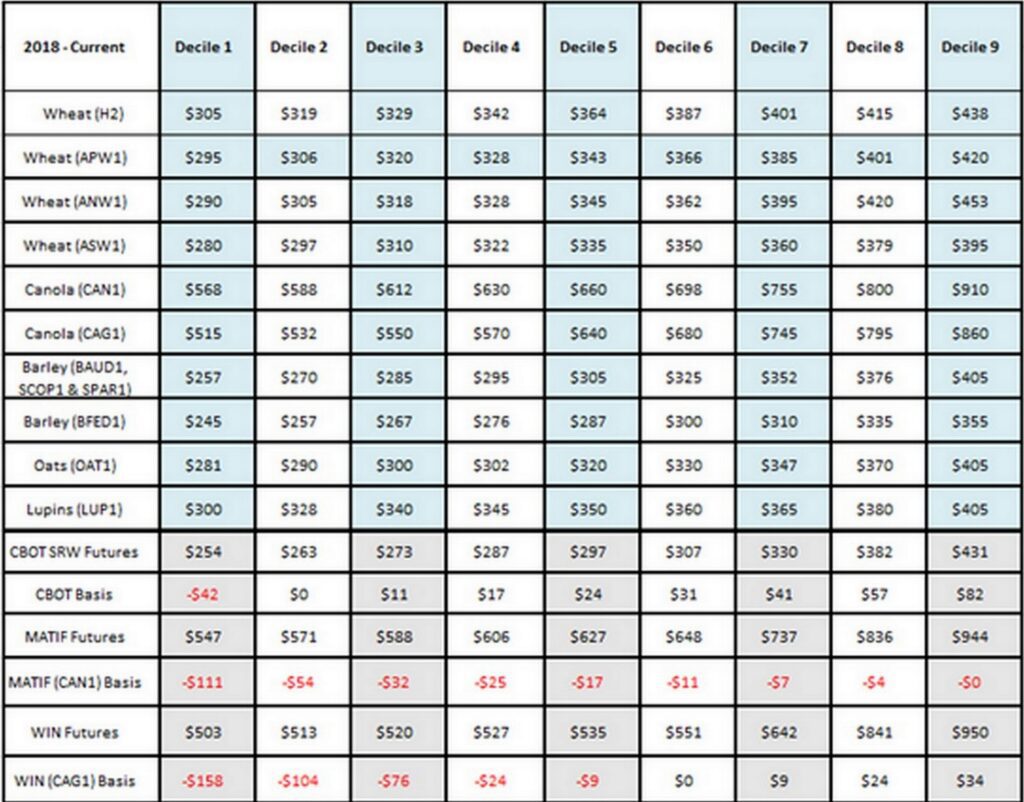

Deciles continue to play a major role in our grain marketing strategies although the past few seasons have seen deciles sidelined to some extent particularly when pricing sat beyond decile +9 and 10 together with low production confidence.

Our past 2 season’s pricing has created new highs and new lows together with a significant widening between Decile 8 and 9’ levels across all commodities.

So, in line with our renewed optimism and a fresh season start, your grain marketing team are well equipped. Let’s revisit your Masterplan in co-ordination with your estimated 2024 season program – it’s all we need to get started.

We look forward to a new season, perhaps more attuned to embrace market volatility and the opportunities that come our way.

Chart 3 – Planfarm Deciles