Let’s say that you’re a grower, and you have just spent 3 months of your season caring for and growing a first-grade line of cabbages. Once picked and packed, you approach a buyer and negotiate a price and 30-day terms. Produce is sent off to the buyer with an invoice. Fourteen days later you get paid, but the invoice amount is 5% less than you agreed. You check the crate charges and they are correct, you check the $/unit sale price and that’s correct, you check the levies charges, they are correct, but then you find what you’re looking for, and it’s called a “discount on early settlement”.

A discount on early settlement is a tactic that is used in many industries to encourage prompt payment of invoices. The product or service is discounted by a percentage if the invoice is paid early. For suppliers, a discount on early settlement can assist cashflow by quickening payment timing, and for the buyers, it reduces the cost of goods by a known percentage. These discounts on early settlement agreements are typically initiated by the supplier.

So, why am I writing about it in this landline issue?

The answer is underlined above. In many industries, a discount on early settlement is typically initiated by the supplier. In our horticulture example, the discount on early settlement is not initiated by the grower but by the buyer!

This sort of discount on early settlement is consistently seen with big buyers in the fruit and vegetable industry, with growers of all sizes being slugged with a significant discount on early settlement, in the order of 3% – 5%, which has entirely been initiated by the buyer and not the grower. The grower may not have negotiated a premium price for offering extended terms so they wear the full cost of the discount through decreased margins.

This discount has significant implications for the intensive horticulture industry where the 6-year average operating efficiency is 75% and the 6-year average operating profit per hectare is $22,419. A 5% “discount on early settlement” is equivalent to $4,484/ha. A cost that is a significant contributor to margin squeeze.

Another way to look at this is a 5% discount on early settlement on $1,000,000 of sales is a $50,000 cost!

As a grower, it is important to understand the impact that a discount on the early settlement could have on your business cashflow and profitability. So pull out those invoices and supply agreements, or stir up your main contact for your buyer and investigate the following:

- Are you being charged a discount on early settlement?

- How much is this discount on early settlement as a percentage of your sales?

- What are your original payment terms, are they 30 days, 45 days, or 60 days?

- What are their payment terms when they charge you the discount on early settlement, is it 14 days or 30 days?

- How are you setting the price?

When you are armed with this information, you will then need to produce some business cashflows to determine the following:

- If you are paid as per your original payment terms, rather than your “early settlement” terms, by how many days will income be deferred?

- In your cashflows, push income out by the number of days worked out above.

- Calculate the increased interest costs for delayed payment.

By doing the above you will work out what your increased debt will be by not having an early settlement.

Your current bank interest rate forms a very big part of the equation when it comes to the cost of the discount on early settlement, and to analyse this see the example following:

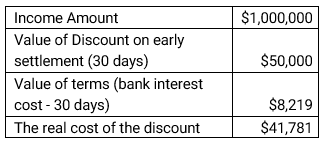

Below, we are comparing:

- $1,000,000 of sales.

- A 5% discount on early settlement for payment 30 days early (payment on day 30 compared to an original 60-day payment terms agreement).

- A 10% bank interest rate.

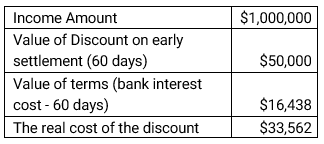

Again, below, we compare a 60-day example:

- $1,000,000 of sales.

- A 5% discount on early settlement for payment 60 days early (payment on day 30 compared to an original 90-day payment terms agreement).

- A 10% bank interest rate.

The following formula will assist you in calculating the real cost of discounted terms

Invoice value ($) x discount (%) = value of discount ($)

Invoice value ($) x payment terms (days) x bank daily interest rate (%) = value of terms ($)

Value of discount ($) – Value of terms ($) = Real cost of discount ($).

You now have to overcome the final hurdle…negotiating with your buyer to ensure the contracts are fair for both parties.

Articles written in 2017 (https://www.afr.com/companies/retail/coles-woolworths-early-settlement-discounts-under-scrutiny-20170418-gvmwpe), aligns with the experience of my clients, highlighting that negotiating out of this discount on early settlement is a difficult process.

As a grower, continuing to put pressure on the buyers regarding this cost is a must, and now that we are seeing increased pressure on certain buyers, and with an independent review on the “Food and Grocery Code of Conduct” (which automatically covers farmers who supply grocery products) being performed in 2024, it might just be the right time to ask the question.

So if you’re a grower who has been getting charged this discount on early settlement, get in contact with our horticulture team today. Planfarm will be able to calculate your peak debt for the season, and assist in planning and structuring your loan facilities with your lender to reduce interest costs whilst maintaining flexibility. Planfarm will also be able to act as a link to specialist services that can assist you with negotiations, cost recovery, and courses that will train your team to become better negotiators.