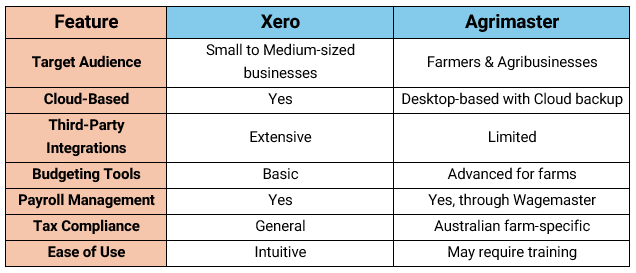

Accounting software is crucial for managing financial transactions and ensuring compliance. Xero and Agrimaster serve different markets: Xero is a cloud-based solution for small to medium-sized businesses, while Agrimaster specialises in farm accounting. This article explores their key differences to help businesses choose the right tool.

Overview of Xero

Xero is a leading cloud-based accounting platform for small and medium businesses. Its user-friendly design and automation features streamline financial management.

Key Features:

- Cloud Access: Real-time financial tracking from any device.

- Automated Bank Feeds: Simplifies reconciliation by importing transactions.

- Invoicing & Billing: Custom templates and automated reminders.

- Payroll Management: Handles salaries, tax, and superannuation.

- Third-Party Integration: Connects with over 1,000 apps.

- The functionality of posting journal entries allows easy management of accounts for accounting purposes.

Overview of Agrimaster

Agrimaster is designed for farm and agricultural accounting, providing tailored tools for tracking farm finances and budgets.

Key Features:

- Farm-Specific Budgeting: Manages seasonal income and expenses.

- Grain & Livestock Tracking: Essential for profitability analysis.

- Cashbook Management: Organizes farm transactions.

- Tax & Compliance Tools: Ensures compliance with GST, BAS, and payroll tax.

- Calculates the fuel rebates for the user, making BAS lodgement simple.

- Multi-Enterprise Support: Manages multiple farm operations under one account.

Comparing Xero and Agrimaster

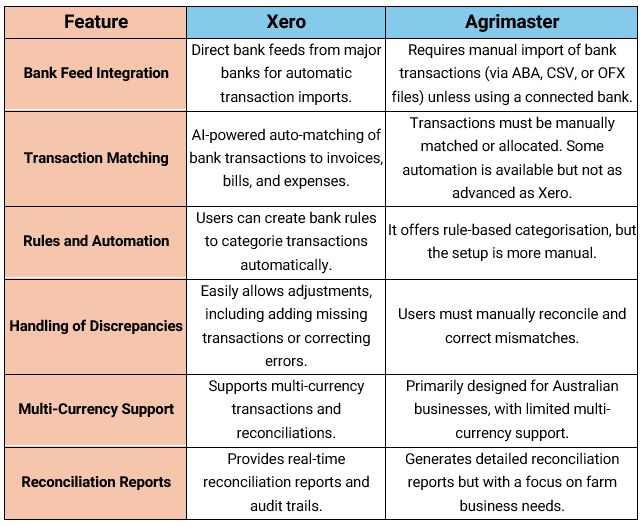

Bank Reconciliation in Xero and Agrimaster

Bank reconciliation ensures financial records match bank statements.

Xero automates this by importing transactions and suggesting matches based on past data, reducing manual work.

Agrimaster, however, requires manual reconciliation, offering a more detailed overview of farm finances but demanding extra time.

Bank Reconciliation Process in Each Software

- Coding in Xero

Xero uses a chart of the accounts coding system, allowing businesses to customize categories.

- Uses bank feeds and automatic bank reconciliation but requires users to categorize transactions manually.

- Bank Rules: Automates transaction coding.

- Tracking Categories: Categories revenue/expenses by project or department.

- Custom Chart of Accounts: Businesses can create unique account codes.

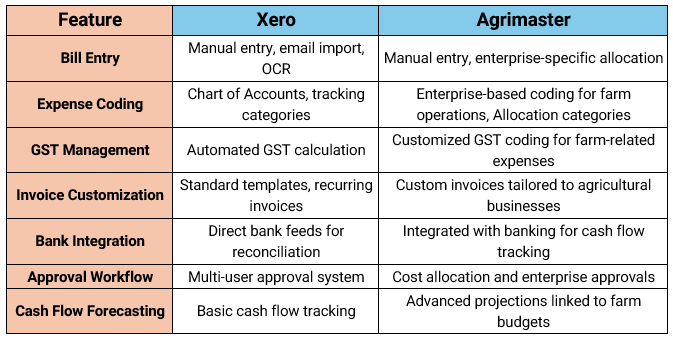

a. Bill Processing in Xero

Xero simplifies bill management through a streamlined process:

- Entering Bills: Users can manually enter or import bill details via email.

- Attachments and OCR: Xero allows receipts to be attached and uses OCR (Optical Character Recognition) to extract bill details.

- Coding Expenses: Xero enables expense categorization based on the Chart of Accounts, ensuring proper allocation to cost centres.

- Approval Workflow: Users can set up a bill approval process, preventing unauthorized transactions.

- Payment Scheduling: Bills can be scheduled for payment, ensuring timely vendor payments.

b. Invoice Coding in Xero

Xero’s invoice coding system follows a structured approach:

- Itemized Coding: Users can assign specific ledger accounts to each line item in an invoice.

- Tracking Categories: Businesses can create tracking categories to allocate income or expenses to different departments or projects.

- GST Handling: Xero automatically calculates GST (if applicable) and applies tax codes based on predefined rules.

- Recurring Invoices: Automated recurring invoices reduce the manual effort for regular transactions.

- Bank Reconciliation: Xero’s invoice coding integrates seamlessly with bank feeds, ensuring easy reconciliation.

- Coding in Agrimaster

Agrimaster’s coding system is tailored for agriculture.

- Enterprise Codes: Assigns transactions to different farm activities (e.g. Crop, Livestock, Horticulture).

- Cost Category Codes: Group expenses (e.g., fertilizers, fuel, veterinary costs) and cost allocation allow detailed cost tracking.

- GST-Specific Coding: Ensures compliance with tax regulations.

- Cashbook Entry System: Requires coding for each income and expense transaction to track farm cash flow accurately.

a. Bill Processing in Agrimaster

Agrimaster follows a detailed bill coding approach, ensuring farm-related expenses are correctly allocated:

- Transaction Entry: Bills are manually entered into Agrimaster with a focus on farm-specific cost categories.

- Enterprise Coding: Unlike generic accounting software, Agrimaster allows users to allocate bills to specific farming enterprises, such as livestock, cropping, or machinery.

- GST and Tax Codes: Users can define tax codes for each transaction, ensuring compliance with agricultural tax regulations.

- Cost Centers and Allocations: Farmers can split bills across multiple cost centres (e.g., fuel costs shared between machinery and general farm operations).

- Batch Payments: Agrimaster enables batch processing of bills, allowing users to process multiple payments simultaneously.

b. Invoice Coding in Agrimaster

Agrimaster’s invoice coding technique is designed to cater to farming-specific income and expense tracking:

- Enterprise-Based Coding: Users can allocate revenue and expenses to different agricultural enterprises.

- Customizable Invoice Templates: Agrimaster provides custom invoice formats that align with farm operations.

- Detailed GST Management: Users can define GST rates based on specific farming transactions.

- Banking Integration: Agrimaster allows direct integration with bank transactions, reducing manual reconciliation.

- Cash Flow Projections: Invoices are linked to cash flow forecasts, helping farmers predict future income and expenses.

Key Differences Between Xero and Agrimaster in Bills and Invoice Coding

Xero and Agrimaster cater to different financial management needs. Xero is best for SME’s seeking automation and cloud access, while Agrimaster suits farmers who require detailed tracking of farm-related expenses and budgeting.

Xero’s automated coding and flexible chart of accounts streamline general business accounting. Agrimaster’s farm-specific coding techniques ensure precision in tracking agricultural finances.

Choosing the right software depends on industry needs, integration preferences, and financial complexity. Businesses should assess their requirements to select the most suitable platform.