In the world of grain marketing, we have experienced high volatility for some time, especially since the Ukraine–Russia war in 2022, and while the extreme volatility has decreased somewhat, it appears more uncertainty and ongoing volatility lies ahead for the grains market.

Trump’s April 2nd “Liberation Day” tariff announcements wreaked havoc financially across the globe. The Australian dollar dropped 5c to 59.15c, back to its lowest level since the COVID pandemic and its weakest point since March 2020. The decrease, albeit briefly, created swift grain selling opportunities for unsold old-season and new-season grains. As a major global grain exporter, an Australian currency move is pivotal to our local market pricing, and while grain pricing didn’t exceed season highs, our pricing returned to meet target levels in the vicinity of decile 7 to 8 levels.

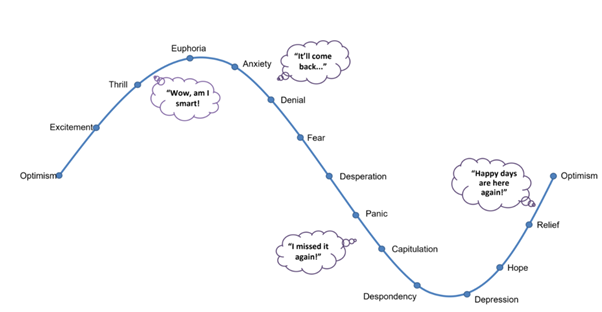

During times of volatility, it is easy to be swept up in excitement and willingly ride a market rally, looking to capture higher levels. Of course, growers, traders & grain marketers get swept along in the wave of emotion, looking to reach the magical market peaks too.

As we roll into a new season amongst geo-political uncertainty worsened with the world’s top trading heavy weights set to intensify market volatility, opportunity is very likely to present. So, while the market has been relatively subdued of late, it’s an ideal time to revisit your grain marketing plan.

Grain marketing without a plan can be compared to riding a roller coaster driven by fear and greed, powerful emotions that cause us to experience the highs & lows along the way. Understanding and recognising this cycle can help us make informed and rational grain marketing decisions.

Removing the Emotion from Grain Marketing – Fear & Greed!

The fear and greed cycle is a concept from behavioural economics applies well to grain marketing. Growers, Traders and Grain Marketers (like all market participants), are heavily influenced by emotions, especially fear (of loss) and greed (of missing out or making more profit).

Illustration 1 – Emotional Grain marketing roller coaster

Excitement, greed & pride – prices are high, the Market is Going Up!

Emotion: Optimism & Excitement

Scenario: Prices are rising & reaching season highs. Growers hold off selling, thinking prices will continue to increase.

Mindset: If I wait, I’ll get more. Why sell now? It’s going higher!

Risk: Miss the peak. Markets can drop quickly, eg, USDA WASDE Report data, a weather event or, like our current environment, a geo-political event.

Hesitation, regret & hope – Prices drop unexpectedly.

Emotion: Hope, doubt, denial & regret

Scenario: Markets start falling. Perhaps a USDA report increases plantings, tonnage estimates increase and/or export demand weakens.

Mindset: I should’ve sold at the top, maybe the price will return.

Risk: Holding too long. Hoping for a rebound instead of accepting a smaller (but still) market price.

Fear & Panic – Prices are dropping.

Emotion: Anxiety & panic

Scenario: Prices continue to fall, farmers rush to sell to avoid lower grain pricing.

Mindset: I just need to sell before it gets worse.

Risk: Selling at or near the bottom.

Desperation & distress – Market bottoms out.

Emotion: Despair and despondency

Scenario: Growers have now sold & market stabilises .

Mindset: It’s over. I can’t make money at these prices.

Risk: Emotional exhaustion & missing an opportunity to implement a new plan.

Optimism & recovery – Prices begin to rise.

Emotion: Hope and relief

Scenario: Demand increases, weather concerns emerge, or global supply tightens.

Mindset: Maybe things will turn around.

Risk: Not being prepared to act when the market rebounds.

Confidence – Prices recover

Scenario: The Market looks healthy. Sales can be made at higher prices.

Mindset: I knew it would come back.

Risk: Becoming over-confident & starting the greed cycle again.

Ongoing grain market pricing uncertainty emphasises (now more than ever) the need for your grain marketing plan. Written plans will guide your actions into the future, ensuring you are well-positioned to act when opportunities arise. Without a plan, the emotional fear and greed rollercoaster cycle can be difficult to suppress and can often derail your results.

Planfarm Marketing’s Master Plan is an ideal starting point, and it’s a great time to refine your Master Plan or contact one of our Planfarm Marketing advisors to implement your Master Plan using your data (eg, long-term average yields) together with Planfarm Marketing’s historic pricing deciles to formulate your strategy.

While trolling through the aftermath of Trump’s Liberation Day tariffs in an attempt to interpret the market, Barchart (barchart.com) promptly reminded me of the need to go back to our plan…

Monday, April 7th, 2025 Barchart

‘Successful investors rely on data and rules, not headlines or rumours, they have a plan. Study the charts and signals to guide your decisions, not trending tickers, or astronomy….

Let’s be honest, none of us knows what the future holds for grain prices, but your Grain Marketing Master Plan will pave the way as opportunities arise.

Onwards and upwards towards our 2025/26 season & we look forward to hearing from you soon.