I’m sure you are well aware that interest rates have been reducing for farm businesses in 2025, with most banks passing on a 0.5% – 0.75% reduction in rates depending on how they structure their products. Based on the 2024 Planfarm Benchmarks data, a 0.75% reduction in interest rates would save the average farm business approximately $16,738 every year.

The real opportunity however is that many farmers can capture savings well beyond the 0.5% -0.75% reduction! Through our work with clients and observing the success of the Planfarm Finance team, we’ve seen that the right approach can help to capture these savings.

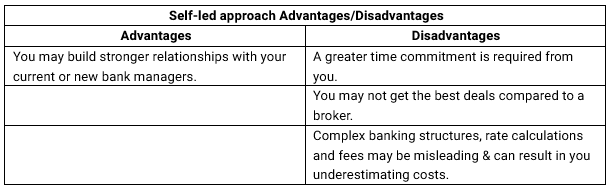

Self-led approach:

If you’re comfortable with negotiating with banks, have a good understanding of your business structure and finance structure; and have some spare time on your side you can undertake the process yourself.

The process:

- Approach your current bank, provide them the opportunity to retender for your businesses finance needs – potentially make them aware that you will be shopping around!

- Contact other banks/bank managers that you would be interested in working with. These bank managers will let you know what they require to quote for your businesses finance.

- Meet with the potential bank managers to learn about their products, and what they are offering

- Compare your offers – the most critical and complex step in the whole process. Compare each offer and bank on the following:

- Structure – Does the proposed structure suit your business needs, is it user friendly? Is it the most cost-effective structure?

- Yearly Cost – Headline rates can sometimes be misleading, make sure to scrutinize how each bank sets interest rates (such as BBSY + Margin formulas) and how each bank sets their fees (line fees, unused facility fees, annual fees).

- Setup costs – make sure that you account for all government charges (title searches, mortgage charges), valuation costs and once off application fees in your comparisons.

- Term of the facility – This not only refers to the total term of the facility provided (or be reviewed), but also the term of the client margin – how long will this remain the same?

- Principal repayments – does the offer require you to make principal repayments, or is it up to you request to make these?

- Other features – what other features does each bank offer (fixed rates, SWAPS facilities,

- Relationship – Referring to the working relationship between your business and your bank manager, which can be hard to judge for new banks who you may have only met a couple of times

- After doing all of the above, decide about what you wish to do!

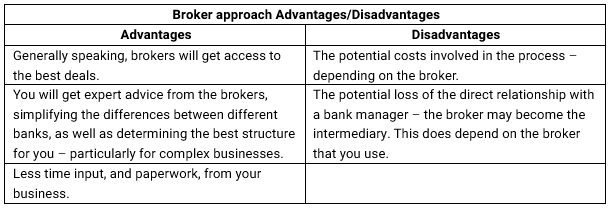

The broker approach:

If you’re time poor, have a complex business structure and finance structure, and are not entirely comfortable with negotiating with banks, the broker approach may be the best approach for you.

The process:

- Find a suitable broker.

- Let them undertake the process mentioned in the above, communicating with you at each step.

Some items to consider when looking for a broker:

- Make sure that they are an agricultural focused broker, with an understanding of the finance requirements of farm businesses.

- Make sure you understand how the relationship and contact will work post brokerage with your current/new bank.

- Make sure that you understand the cost:

- Cost to engage – what will be the cost be to engage the broker and prepare the documents.

- Cost to stay – what will be the cost if your current bank provides the best offer, and you choose to stay with them.

- Cost to leave – what will be the cost if you decide to switch banks.

The commission myth – Brokers will often be offered a commission from banks to bring them business and it is often thought that this commission is paid for by the client (you). But the reality is that banks are happy to pay the broker for delivering a pre-vetted client and handling the paperwork, as it reduces the direct costs it would otherwise face. That being said, your broker should always communicate what brokerage they will receive when discussing finance offers with you.

Although not expanded on in the above, finding a suitable broker, who puts your needs first, is the most important step. In my experience in working with the Planfarm Finance team, it has been an easy process for the clients. With good communication between the client, Planfarm Finance, and the consultant meaning less work for the client. The Planfarm Finance team have also always put the client first; they have always looked at the clients wants/needs and worked towards meeting these – resulting in savings above that 0.75% mentioned earlier!

There are significant savings to be had, and the longer you wait to act, the more it is costing you. So, roll up your sleeves, pick up your phone, get to work to save yourself $16,000+!