Written on the 28th November, 2025.

Welcome to the first edition of Rateline. This feature article will be in the Landline newsletter immediately after each Reserve Bank of Australia (RBA) Board meeting and target cash rate announcement. There are eight announcements per year with the next one on the 18th February 2026. In these articles we will unpack the RBA’s recent decision on their target cash rate, discuss the key market drivers and consider what it means for borrowers. In each article there will also be a focus piece on an important component of the finance system, in this article it will be the interest rate forward curve.

Disclaimer #1

The information and commentary in these articles are not financial advice. Please speak to a financial advisor and consider your own needs and objectives before acting on anything you read in these articles.

If you would like more information on what you read in these articles or like to discuss your own financing arrangements, then please reach out to myself or Andrew Tasker. We offer a range of finance services, including a finance Health Check, finance restructuring, and finance broking.

The role of the RBA in determining interest rates in Australia

The RBA plays a very important role when determining interest rates in Australia. They do this by setting their target cash rate. The cash rate is the interest rate on overnight loans between commercial banks. RBA influencers the cash rate by increasing or decreasing liquidity into this overnight market. Banks and other lenders then adjust their borrowing and lending rates to clients relative to the overnight cash rate, which is regarded as the risk-free rate. The banks will add in a margin for their costs of doing business, the risk involved, a client margin and their desired profit margin.

The RBA’s core objective is threefold:

- to promote price stability (i.e. keeping inflation between 2% and 3%),

- to maintain the maximum sustainable level of employment (considered around 4% unemployment but is dependent on inflation) and,

- to sustain economic prosperity and welfare for all Australians (this includes housing affordability).

When setting their target cash rate, the RBA considers many factors. These can be broken down into five main categories. In subsequent Rateline articles we will comment on each of these categories.

- Inflation data – The main indicator is the consumer price index (CPI), which is the change in price of a basket of goods and services. There are also trimmed mean or core CPI. We will explain the difference in future articles.

- Labour market conditions – The unemployment rate is the key indicator, with around 4% seen as a sustainable level without causing significant inflation. Underemployment, wage growth, and spare capacity are also considered.

- Australian economic activity and growth – The gross domestic product (GDP) is the main measure and is the total monetary value of all the goods and services produced in a given period. Other considerations include Government spending (known as fiscal policy), consumer spending and confidence, and business spending and confidence.

- Global economic activity and financial conditions – This looks at the beforementioned considerations for other countries, particular the biggest economies and trading partners, such as the US, China and the EU. It also encapsulates trade relations, international interest rates, and foreign exchanges.

- The effectiveness of monetary policy – As the Global Financial Crisis in 2008 reminded us, the financial machine doesn’t always operate as expected and the cogs can seize up. This consideration looks at how the RBA’s changes in their target cash rate flow through to the wider economy.

Summary of key data – Bouncing out of the Goldilocks range

| Recent Period |

Previous Period |

Reporting Periods | Change | |

| Real GDP Growth | +0.6% | +0.3% | June and March Quarters | Up |

| Headline CPI | +3.2% | +2.1% | Sept and June Quarters | Strong rebound |

| Core CPI | +3.0% | +2.7% | Sept and June Quarters | Up |

| Unemployment Rate | 4.3% | 4.5% | Oct and Sept Months | Down |

| Underemployment Rate | 5.8% | 5.8% | Oct and Sept Months | Stable |

| Wage Growth | 3.4% | 3.4% | Sept and June Quarters | Stable |

| Household Spending | +0.7% | +0.4% | June and March Quarters | Increasing |

| Consumer confidence | 103.8 | 92.1 | Nov and Oct months | Up sharply |

| Business Spending | +3.5% | 0.1% | June and March Quarters | Strong rebound |

| Business Confidence | 101.7 | 101.6 | Oct and Sept Months | Stable |

Up until recently, key data for the Australian economy was sitting in the RBA’s Goldilocks range, with the likelihood for another interest rate cut in early 2026. However, headline and core inflation have rebounded from the recent downtrend and now sit at the top end or above RBA’s target range of 2-3%. Combined with an increase in household and business spending, an increase in house prices, and a drop in unemployment, it has tempered the market expectations for further interest rate cuts in the short term. In other words, the economy doesn’t currently need much more stimulating, and the market is more concerned about persistent inflation and a slightly tight labour market. Bringing sticky inflation back into the 2 – 3% range will be the main determinant for what the RBA does with rates in 2026.

Focus Piece – The Forward Curve

Disclaimer #2

It is critical to note that the forward curve is not a forecast or even a prediction of where interest rates will go in the future but rather the collective expectation of market participants. It is very fluid, moving constantly with each piece of news and data. Very similar to how wheat futures are the market’s expectations for the price wheat in the future. One unforeseen major global event can change market expectations instantly.

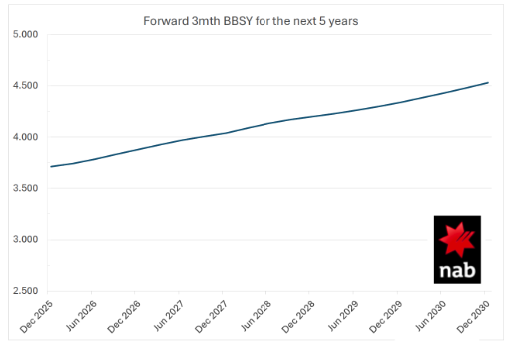

The forward curve can be crudely summarised as the market participants’ bets on where they think interest rates will go in the future. It encapsulates several markets driven interest rate products such as interbank cash rates and futures, bank bill swap rates (BBSW) and Government Bond Yields, which are standardised in a process called Bootstrapping, and then put on one simple graph, displayed below.

Figure 1. Forward Curve using BBSY for the next 5 years. Source: NAB, Reuters, 28th November 2025

The relevance of the forward curve to borrowers

As mentioned above, the forward curve is the market’s expectations for where interest rates will go in the future. In other words, it’s like looking at the markets homework when trying to work out where interest rates will go. The market won’t get it right but it will generally get it more right than us. We can therefore use this curve when making important decisions around debt, such as taking on debt to buy a farm or house, or when fixing interest rates for a period.

At the moment, the forward curve is telling us that the market is no longer expecting an interest rate cut at the RBA’s December meeting (flat curve) and is now factoring the possibility of interest rises in 2026. Refer to Disclaimer #2.

If a borrower decides they want to reduce their exposure to changes in interest rates, they may look to fix or hedge their interest rate using one of the many tools available to them. Refer to Disclaimer #1.

The focus piece in the next edition of Rateline will be a look at APRA’s role in the Australian financial system and consider their new lending rules, which come in to effect on the 1st Febreuary, 2026. APRA is pumping the breaks on borrowers in the residential housing market that are flying a bit close to the sun (debt to income ratio above 6). See this article for a sneak peek.

Jerome Critch of Planfarm Marketing Pty Ltd is an authorised credit representative (CRN 555 942) of Provsight Pty Ltd (ACL 429 904).

DISCLAIMER #3 – This newsletter article is for informational and educational purposes only and does not constitute financial or investment advice. The information provided herein regarding interest rates, economic forecasts, and market trends is based on publicly available data and professional opinions, which may be subject to change without notice. Always consult with a qualified financial advisor, tax professional, or mortgage broker before making any personal financial decisions or transactions.