Written by: Cameron Weeks | Farm Business Consultant | 0427 006 944

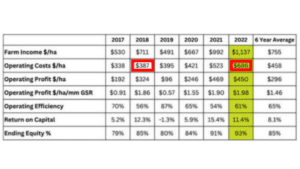

What do you read into the below table from the 2022 Planfarm Benchmarks publication? Record income in 2022? Record profits in 2021? Fantastic returns on capital? Ending equity at an amazing 93%?

Anyone else read massively inflated risk? Have a look at the increase in operating expenses over the period.

2018 was a big production year, in fact a record at the time, so is a reasonable comparison with 2021 and 2022. In 2018 operating expenses were $387/ha yet in 2022 they were $686/ha – that is an increase of 177%. Excuse my language but bloody hell!

The charts below and overpage showing the typically ‘big 5’ operating expenses highlight this point further but right across the board inflation has impacted the cost of production.

Aside from operating expenses the other obvious expense areas that have increased massively include interest rates, lease rates and of course machinery where the values involved are now quite mind boggling.

Thankfully farmers lucked it (sorry – that is a bit unfair as skill certainly did come into it) with fantastic seasons equating to great production which when combined with excellent prices allowed for income to be through the roof sheltering all and sundry from the massive inflationary pressures.

I write this not wanting to alarm nor undermine just how good things have been in the business of farming over the past small handful of years as they truly have been amazing, but I do wish for all to consider the increased financial risks associated with poor production. Unfortunately, this will be a key take home for many in the northern and eastern wheatbelt regions where crop production will mostly range from well below average to poor and, in extreme cases, almost complete failure.

From numerous budget revisions we have done with clients it is clear that the resulting losses will be the largest ever recorded. Doesn’t seem logical does it that a business can go from record profits (2021 & 22) and then a record loss!

Thankfully most started in extra strong financial positions so will be fine even with such a poor result but there are exceptions unfortunately.

The other risk factor seemingly even more at play now is price volatility both input and output. Think fertilizer, chemical, diesel plus CBOT wheat and recently livestock prices.

So, what does this mean?

From my perspective what this means mostly applies to those looking at expansion through purchasing or leasing, especially if the scale of the expansion opportunity or effort is large relative to existing scale. Given that you likely will have to pay a record or near record price to buy or lease it is really important that you consider the extra exposure you will have to a poor result.

The bottom line is that with increased financial risk it is more important than ever that you retain a healthy financial buffer allowing you to borrow / fund your way through a poor result or two (?) so that you get through to the good years where the money is made.

Of course, where you farm and reliability of production, as always, comes into consideration but so does the fact that some locations are no longer as reliable as they once were so bear this in mind. Certainly, the best indication of stability of production and profitability is your own history so do focus on this to bring some reality.

From a financial ratio perspective what am I talking about here? Equity % of course but primarily your peak total debt as a percentage of land value or what you have available to secure the loan (mortgage). This is commonly referred to as the loan to valuation ratio (LVR).

Example: Peak debt of $3M on $6M of land is an LVR of 50%. We know banks typically don’t like lending past 60% so as you consider an expansion opportunity keep this in mind (and I can tell you changing banks won’t greatly change this consideration).

We present in our annual review report a standard benchmark of keeping LVR below 50% (inc after a purchase) as this means you have a minimum of 10% of the value of farmland typically as your financial buffer.

I would argue with financial losses possible larger than ever plus price volatility plus of course higher interest rates which equate to debt costing approximately 3 times what it did not long ago that you need to consider financial risk seriously when consciously taking on debt. What is an appropriate LVR? Your call but in my mind <45% is now more appropriate in most locations and possibly lower where volatility is great.

So, ponder, are you really sure you wish to ‘stick your neck out’ to buy that extremely expensive farm next door?

Make sure you consider the impact of a poor year or two when you weigh up the opportunity. It would be a shame to go from a financial position of such strength to a vulnerable one all because you took a risk and copped a poor year or two first up – especially if that risk was not really carefully thought through.