Profitability in farming depends not only on production outcome but also on having a clear understanding of costs and the revenue needed to remain financially sustainable. One key financial metric is the break-even point – it tells you how much income you need to cover your costs, both fixed and variable. Understanding your break-even point is essential for making informed decisions regarding crop choices, input spending, pricing strategies, and risk management and can help to determine the required yield, price or even the whole of business production.

What Is a Break-Even Point?

The break-even point occurs when your total revenue equals your total costs – all your expenses are covered, but no profit has been made. In other words, it is the minimum income your farm needs to generate to cover all operational costs. Once you exceed the break-even point, any additional income becomes profit.

When margins are often tight and risks are unpredictable, identifying your break-even point can help you evaluate financial viability and make informed decisions about production, pricing, and investment. For example, knowing the income needed to cover your costs can guide whether it is financially viable to grow a particular crop, take on extra land, or invest in new equipment, especially when dealing with fluctuating commodity prices or planning for a season impacted by drought or flooding.

How to calculate your break-even point.

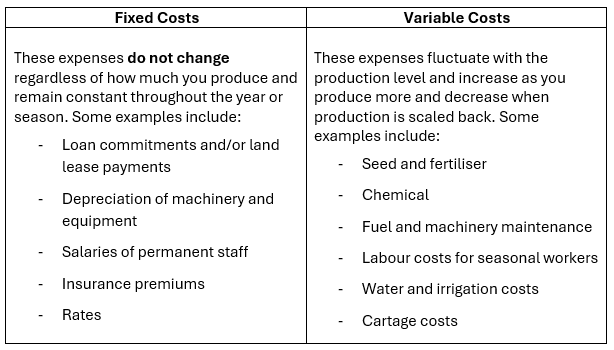

To calculate your break-even point effectively, you first need to understand the two key components of farm costs: fixed and variable costs.

The break-even point can be calculated in a few simple steps.

Step 1: Identify Total Fixed Costs

First, calculate your total fixed costs for the period (typically annually). These costs do not change, regardless of how much you produce. Fixed fees can be apportioned between enterprises based on land area and/or revenue (see example 3 below).

Step 2: Identify Variable Costs per Unit

Next, calculate your variable costs per unit (eg per hectare or per head). For example, if you are growing wheat, the variable cost per hectare may include the cost of seed, fertiliser, chemical, fuel and machinery maintenance, water (if irrigated), and any seasonal labour. If producing livestock, variable costs per head may include supplementary feed, veterinary services, cartage, etc.

Step 3: Calculate Your Revenue per Unit

This is the price you expect to receive. Understanding the market price for your commodity is key to calculating the revenue needed to cover your fixed and variable costs. Whilst this number is unknown, using your historical average commodity price is a reasonable starting point, and then adding market commentary to nudge it up or down.

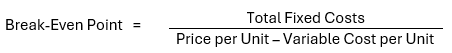

Step 4: Apply the Break-Even Formula

The basic formula is:

This will give you the number of units you need to produce to break even.

Example 1: Single Enterprise Production Break-Even Point

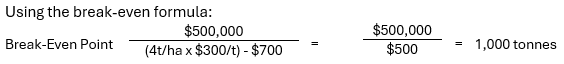

A simple example is a wheat farmer who calculated the total fixed costs for the year to be $500,000. Variable costs are calculated at $700/hectare, with a budgeted yield of 4 tonnes/hectare and a price of $300 per tonne.

Using the break-even formula:

The break-even is 1,000 tonnes to cover costs, and anything greater will contribute to your profit.

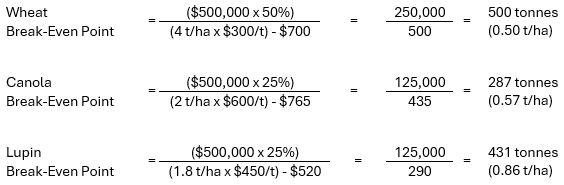

Example 2: Multiple Enterprise Production Break-Even Point

Calculating the break-even point for a mixed farm business is more complex given the different selling prices, variable costs and spread of fixed costs. In this scenario, a weighted average contributing margin (WACM) must be applied to apportion the fixed costs between enterprises. This can be calculated as a percentage of the area planted. For example, the cropping mix includes 1,000 hectares of wheat, 500 hectares of canola and 500 hectares of lupins. The WACM of wheat is 50% (1,000ha/2,000ha), canola is 25% (500ha/2,000ha), and lupin is 25% (500ha/2,000ha).

Example 3: Single Enterprise Price Break-Even Point

Understanding the break-even point of other variables, such as price, can also provide useful information. For example 1, you have sown 2,000 hectares of wheat and expect to produce 8,000 tonnes (4 t/ha). The total fixed costs for the year are $500,000, and variable costs are $700 per hectare.

In this example, you require $237.50 per tonne to cover your costs, and any price above this will contribute to your profit.

How the Break-Even Point Helps in Decision-Making

Understanding the break-even point is not just about hitting a target number of units. It’s a valuable tool for guiding your overall business strategy.

1. Pricing Strategies:

Knowing your break-even point helps you set realistic prices. If market prices fall below your break-even price, you may need to consider cutting back on production or exploring alternative markets. Alternatively, you can determine if your farm is competitive enough to withstand fluctuations in commodity prices.

2. Cost Management:

Once you know your break-even point, you can look for areas where you can cut costs without sacrificing productivity. For example, reducing fuel use, optimising fertiliser application, or investing in more efficient machinery can lower your variable expenses, thus reducing the number of units you need to sell to cover your fixed costs.

3. Risk Management:

By understanding the break-even point, you can plan for risks more effectively. For example, if there’s an unexpected drought, a rise in input costs, or a drop in commodity prices, knowing your break-even point helps you understand the potential financial impact of these changes. It gives you a clearer idea of how much buffer you have before you incur losses.

4. Investment Decisions:

Understanding your break-even point can help you evaluate whether certain investments are worth pursuing. For instance, if you are considering purchasing new equipment or expanding your production, you can use the break-even analysis to assess how the new investment will affect your profitability and the number of units you need to sell.

Regularly assessing your break-even point and other key financial metrics supports short-term decision-making and long-term sustainability of your farm business. This simple metric offers insights into your profit margin and helps guide informed decisions about pricing, production, investment, and cost control. Understanding your break-even point can also strengthen financial health, support future planning, and help navigate challenges such as volatile weather, fluctuating commodity prices, and changing market demands. Whether a small-scale producer or a large enterprise, understanding your break-even point is essential to managing your farm’s ongoing success. Ultimately, success isn’t about producing more – it’s about producing with purpose and precision.