Corporate farms with the big bucks from superannuation funds is one answer.

Mining magnates is another.

Small family-owned farms?

Yes, but…

You need to have your ducks in a row first.

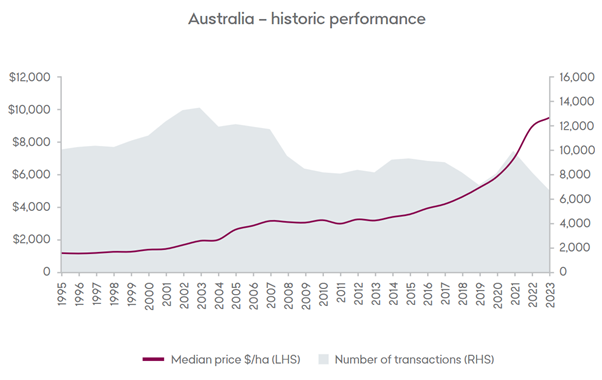

Everybody knows that farmland values have increased substantially in recent years. According to the 2024 Rural Bank Australian Farmland Values report, median prices tripled in 10 years (2014 to 2023). This equates to a compound annual growth rate of 11.6%.

Here’s a chart to put those words into a picture. The chart below is for all of Australia, but every state has a chart that looks like this.

With these high land prices, if a land purchase analysis fails, it’s for one main reason.

Serviceability of the debt

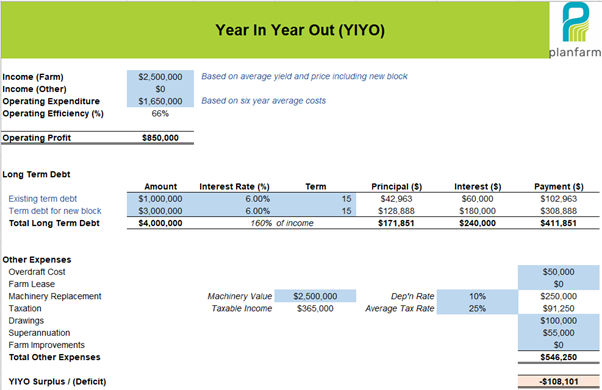

The main analysis that we do to determine debt serviceability is a YIYO (Year in, Year out) analysis. This is where we put in all the income and expenses (including extra income and expenses with the new land) and deduct interest and loan repayments, lease, machinery, tax, and personal drawings. It looks something like this.

What we are looking for is a surplus at the bottom. A surplus demonstrates that the land purchase is achievable and the debt can be paid off over an agreed period. In the example above, it’s very questionable because there is a negative number at the bottom. Also, the banks often ask us to test the YIYO at interest rates about 2% higher than the current interest rate to demonstrate that the business can still make the repayments if the interest rate increases.

It never used to be this hard

Years ago, when a farmer looked at a block of land to buy, the analysis (isolated analysis of the purchase as a stand-alone) would often show a 15% return on capital. If they were borrowing money at, say, 8%, there is a 7% margin. If farmed well, the new land block would help pay for itself.

This is why older farmers may tell you to “pin your ears back and borrow as much money as you can and get on with it”. This is what they did, and it worked.

Nowadays, we may do the analysis and find a 4% return on capital (because the land is so expensive), and the farmer may be borrowing money at 6 or 7%, so the new land is going backwards if they borrow the whole amount (negatively geared!). Sometimes we see an 8% return on capital, and if the business is in good shape, the purchase may be achievable.

It’s worth noting that cash returns of 4-8% plus capital growth are pretty good when compared with other investments (e.g. residential property), it’s just that they are significantly lower than they were even a handful of years ago.

In the low rainfall zone (particularly the northern rainfall zone of WA), we may see a 10-12% return on capital in the analysis, and this farmland can be a very good investment if farmed well.

Who can afford to buy farmland?

Generally speaking, there are two types of family farm businesses that can make a land purchase work at these high prices.

- Where a big, profitable farm buys a relatively small piece of land. The big farm now subsidises the new farmland and can service the debt. And/or

- Where a farm business has farmed well over a number of years and had the discipline to put money in the bank, if they have no debt, and money in the bank, they don’t need to borrow the full amount to purchase the new land, and they can service the smaller debt than if they had borrowed the lot.

There are probably other examples, but these are the big ones.

How does a farm business put itself in a position to buy land?

Having no debt is the key for small to average farm businesses.

Last year I was asked to give a presentation to a group of farmers on the back of a dry year in 2023. The topic I was asked to present was, “What are the habits of successful farmers in a dry year”?

At the time, I asked all 14 of Planfarm’s farm business consultants, and they all said the same thing.

“It doesn’t matter what you do in the dry year; there’s only so much cost you can save. It matters what you do at the end of a good, profitable year”.

In other words, if growers use good years to pay down debt and/or put money in the bank rather than spending it on machines, utes, sheds, boats etc., they put themselves in a strong position to expand in the future if this is their goal.

I sound like a dream killer there. If you want to own a good shed, do things that get you that shed. But if your goal is to expand your farm, then do things to expand the farm, and buy the shed later.

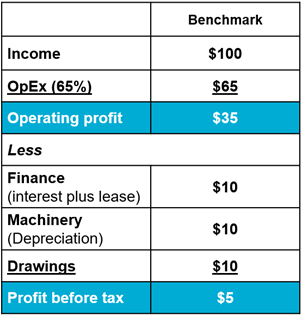

Below is a table that summarises Farm Business Consulting 101. These are the broad targets that we always aim for.

If your goal is to buy land, and you’re not a very large farm business, you may need to first aim to get your business into something like the position below.

In other words, it means farming well (low operating efficiency), having the right amount of machinery for your scale, having personal drawings at the right level for your scale, and having very little or no debt.

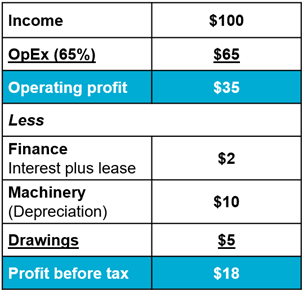

For a small to average farm, if you start with low-term debt, your finance cost as a percentage of income will be very low as it may just be some interest on your overdraft and some lease costs.

If your finance cost is down to, say, 2% of income before the land purchase, then it may increase up to 10% of income after the purchase, and there will still be a bottom-line surplus of 5 to 10% of income. This example demonstrates that the business will have the ability to service the debt as they are still budgeting on a surplus after making all the repayments.

Another option for small farms

Something we have seen with smaller farmers trying to secure land in this high-price market and competing with the larger growers is where groups of 2-4 farmers get together to compete at the same level as a larger grower. Once they have secured the land, they split it amongst themselves. This is another way to pick up a smaller parcel (that is affordable) when it’s a large parcel, or several blocks are put on the market as one. Clearly, this will require sound legal advice, but it has been done successfully.

Summary

Buying farmland is more challenging than it once was due to the high land prices that we are now facing, but it can be done with some careful forward planning. I believe the most important starting point is to meet with your family/business partners and discuss if expansion is your primary goal. If everyone agrees that this is your goal, then your business decisions must follow to put you in a position to expand. It may take several years to put your business in the position to develop, but if you don’t make it your number one goal, it may not happen.